What is Indication-specific Pricing?

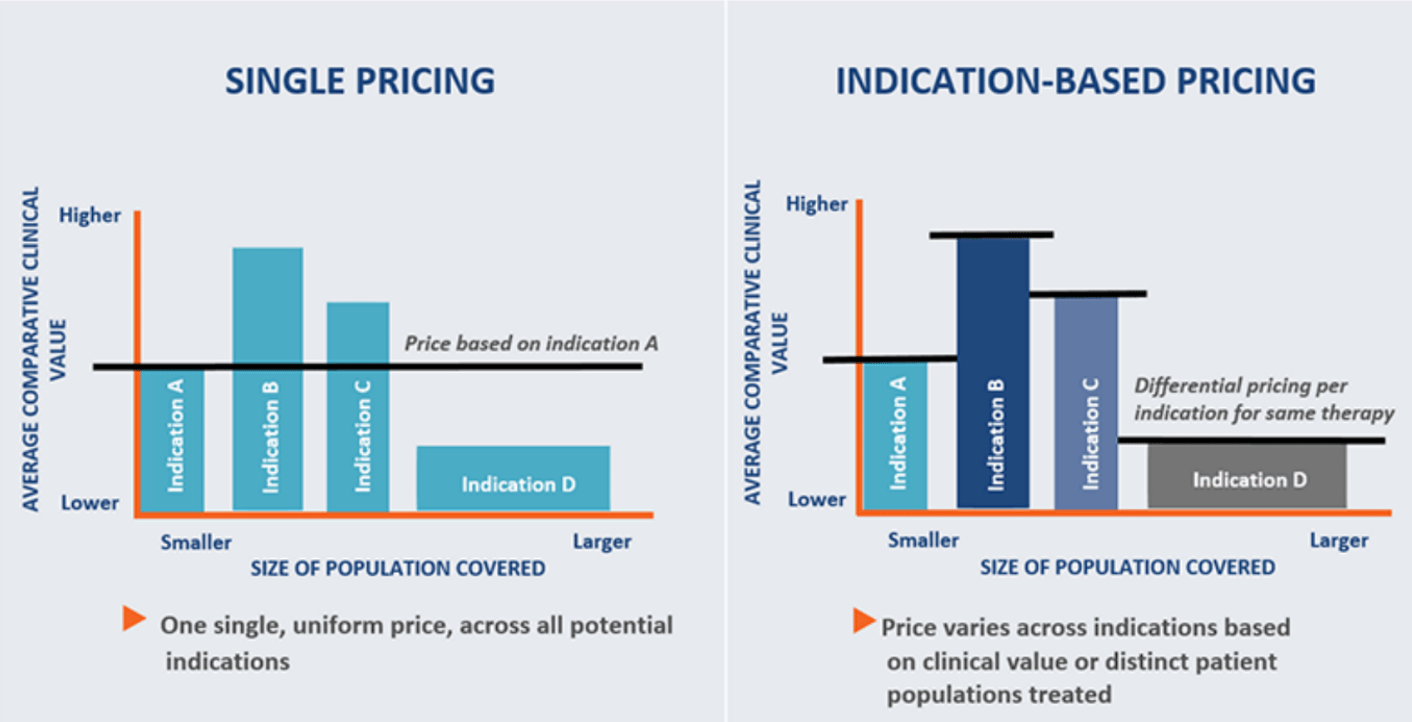

Manufacturers have traditionally charged the same price for a drug regardless of the indication in question. With the new “indication-specific pricing” model, it is suggested that prices for a drug vary depending on the perceived “value/ benefit” of the drug in different indications.

Implications of Indication-specific Pricing on Manufacturers and Payers

Many manufacturers are having to make strategic decisions about what indications they will or won’t launch and in which countries. The stakes are high and the complexities involved in these decisions continue to evolve and morph. Take for example Novartis who recently launched their monoclonal antibody canakinumab (brand name: Ilaris) for a few heritable inflammatory diseases priced at approx $104,000 USD per year. Canakinumab is also indicated for a cardiovascular condition and needs to compete with many generic, low cost statins. What to do? Should Novartis launch the product for the cardiovascular indication only since the market is larger and potentially more profitable? Or should they launch the product for the rare disease indications only since there is less competition and higher potential profit margins? But who is going to pay? What price will cannibalize which indication? And what are the risks for each potential strategy?

According to the Analysis Group July 2017 Report, over a third of the 6,300 products in clinical development are geared towards cancer related treatments and over 800 of these drugs are geared towards “orphan drug designation” both of which are typically very “high priced” ticket items from a drug reimbursement standpoint. Added to that, many of these drugs are being studied in “molecule-indication combinations” or for more than one indication. To prevent the Roche ranibizumab (Lucentis) versus bevacizumab (Avastin) conundrum where physicians are choosing to prescribe the lower priced Avastin off-label instead of using the higher priced Lucentis, indication-specific pricing may be a viable option.

Although indication-specific pricing may offer manufacturers an incentive to develop indications for smaller populations, as in rare diseases, while protecting existing prices for “high value” indications and can assist with strategic decisions on indication, product prioritization and launch planning, it may become more difficult to “prove” added clinical value to payers after a “lower priced” product launches into the market. The perceived clinical value of a drug may constrain a manufacturer in their pricing power over time and may impact the “return for development” for lower value indications. If risks do prove to outweigh the benefits, it is possible, that manufacturers may steer clear of “lower value” indications that may affect patients who are in the most need of innovative therapies, such is the case for rare diseases.

Payers may also see some benefits from indication-specific pricing. This is becoming increasingly important as precision medicine becomes mainstream and more products are being accompanied by diagnostic biomarkers–whether genomic, proteomic or structural–in order to predict which patients will most likely benefit from certain medications. Most importantly, this new protocol could help to save the system significant amounts of money and facilitate patient access to medications. It will also allow appropriate payment for innovative companies and their novel treatments over “me-to” products or indications. It could also help to align nicely with risk sharing programs and protocols with manufacturers. There is no doubt that the administration protocols that will be required to track and monitor a drug’s price for each of its indications could be overwhelming. In addition, the jury is still out on if indication-specific pricing will in fact make drugs more affordable and/or lower patient out of pocket costs. Since both manufacturers and payers want to maximize profit, it is very likely the extra administration costs will be funneled down to patients. To manage the potential backlash of disgruntled customers, payers may need to find alternative ways to “curb” usage through the increased utilization of tools such as prior authorizations and strict usage coverage based on the indication. Finally, it is still unknown if major confusion will ensue when trying to explain multi-priced drug plans to employers, patients and other healthcare stakeholders.

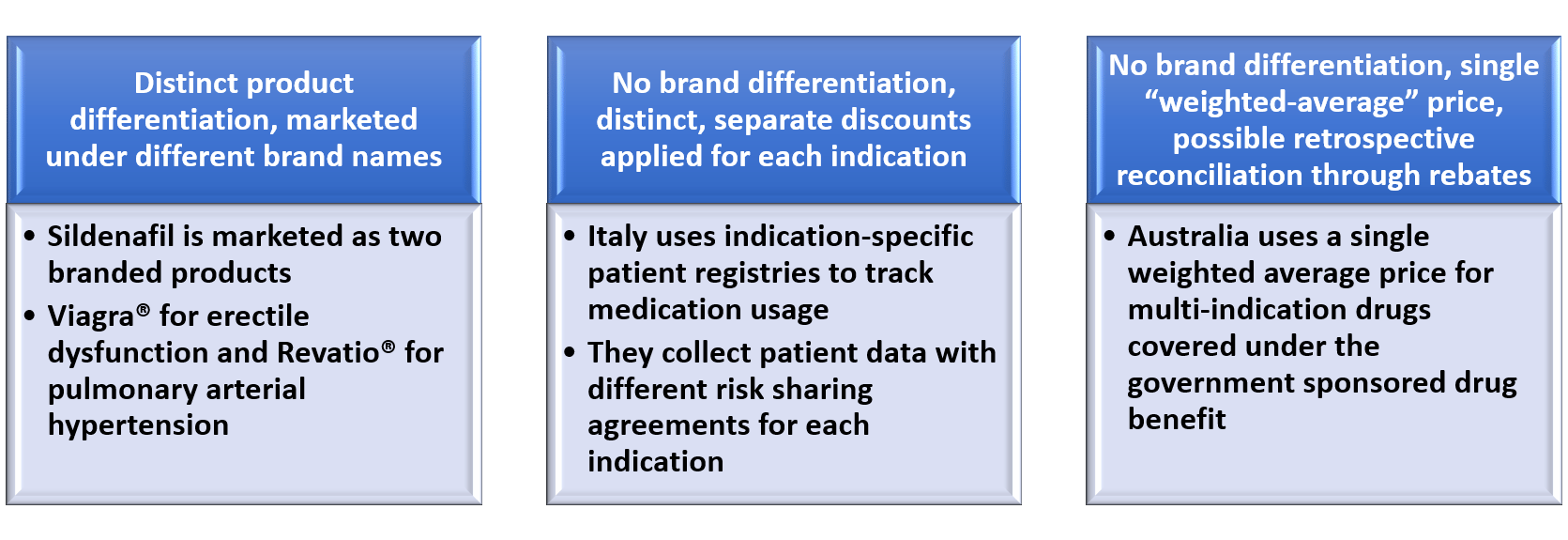

Models for Indication-specific Pricing*

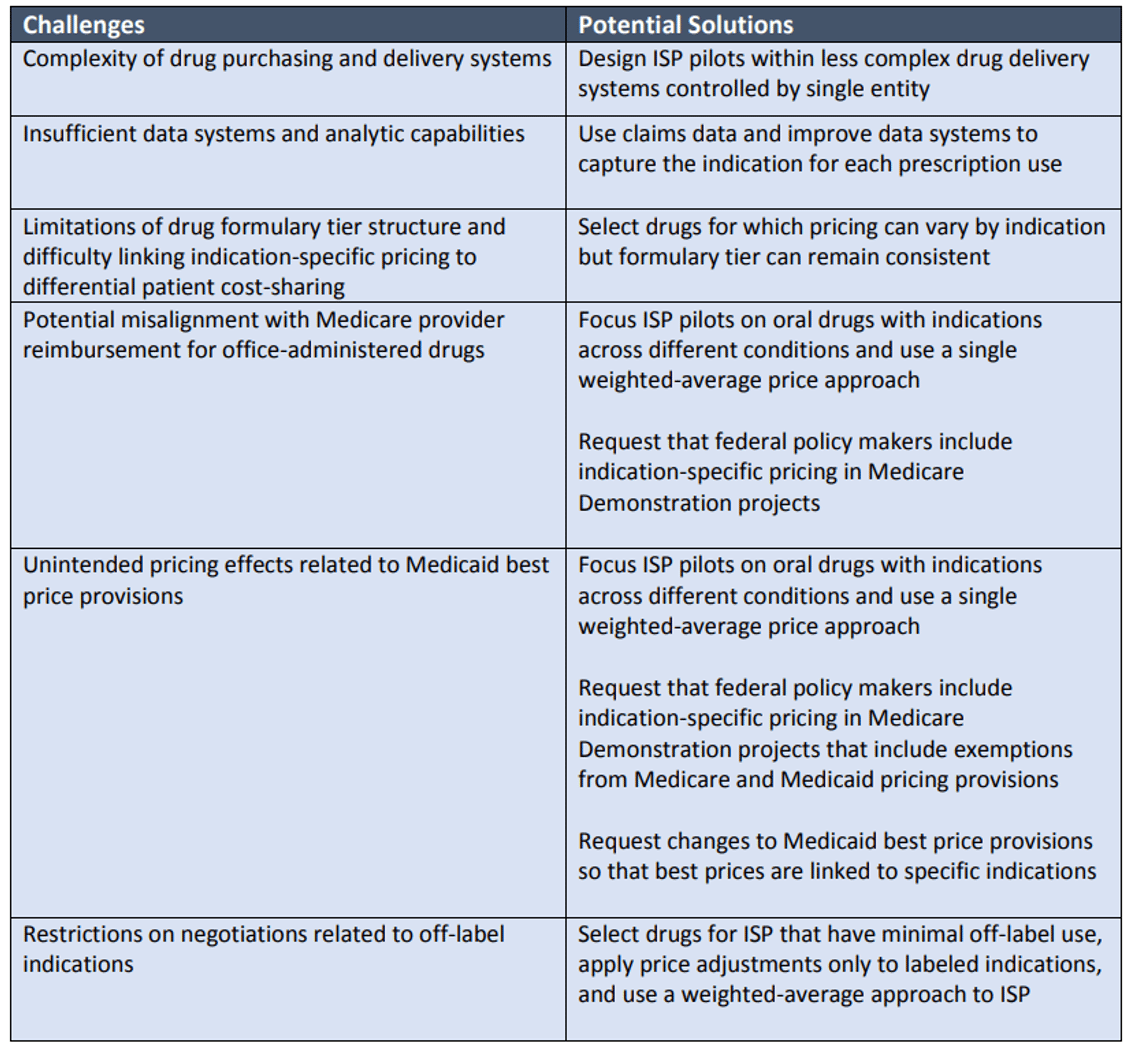

Challenges and Potential Solutions for Indication-specific Pricing Programs in the US*

*Source: 2015 ICER Membership Policy Summit Report “Indication-Specific Pricing of Pharmaceuticals in the United States Health Care System”

*Source: 2015 ICER Membership Policy Summit Report “Indication-Specific Pricing of Pharmaceuticals in the United States Health Care System”

Case Study: cetuximab

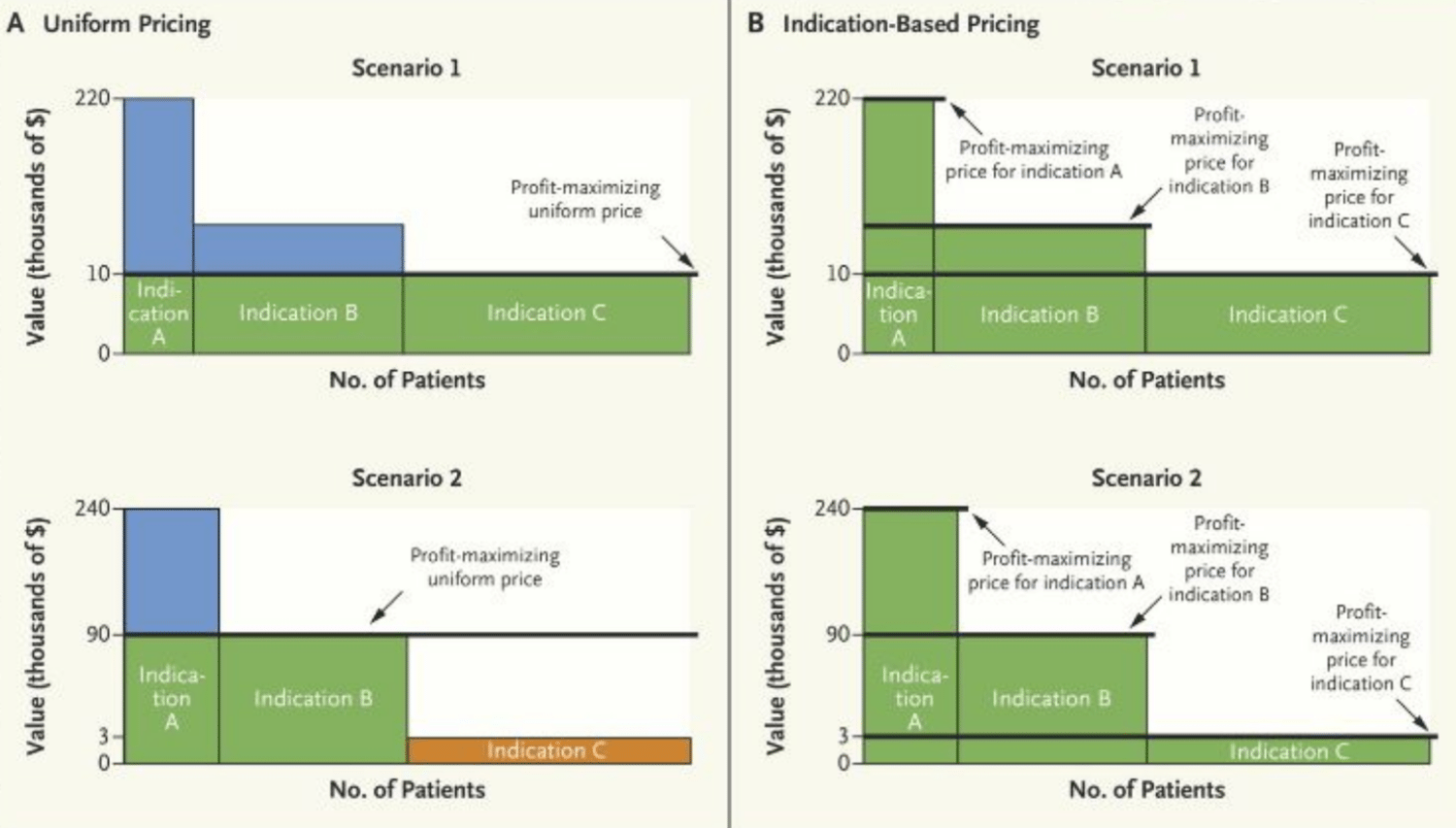

In the NEJM Catalyst article published on September 11, 2017, the authors have illustrated the impact of indication-specific pricing on cetuximab, an EGFR monoclonal antibody indicated for 1st line head an neck cancer and showing a media survival of 0.23 years at a cost of approx $10,000/ month. In Panel A, Scenario 1 in the graph above, with cetuximab priced at $10,000/ month, all patients, regardless of the indication or how many patients have use for that product within that indication, will have access to the drug. The manufacturer’s profit is illustrated by the area in green. The manufacturer has to make a choice of forgoing profits for Indications A and B (considered “higher value” indications and indicated by the blue area) and leaving a “consumer surplus”, in other words, a value difference between the cost of the drug and what consumers would be actually willing to pay for the drug.

In the NEJM Catalyst article published on September 11, 2017, the authors have illustrated the impact of indication-specific pricing on cetuximab, an EGFR monoclonal antibody indicated for 1st line head an neck cancer and showing a media survival of 0.23 years at a cost of approx $10,000/ month. In Panel A, Scenario 1 in the graph above, with cetuximab priced at $10,000/ month, all patients, regardless of the indication or how many patients have use for that product within that indication, will have access to the drug. The manufacturer’s profit is illustrated by the area in green. The manufacturer has to make a choice of forgoing profits for Indications A and B (considered “higher value” indications and indicated by the blue area) and leaving a “consumer surplus”, in other words, a value difference between the cost of the drug and what consumers would be actually willing to pay for the drug.

If, however, as detailed in Panel A, Scenario 2, the manufacturer decides to increase the monthly cost of cetuximab to $90,000/mo, they do so knowing that payers will only cover the drug costs for patients who fall under Indications A and B which then leaves out any potential profit from patients under indication C, as indicated by the orange area. This strategic decision is made in order to maximize profits from their higher value indications, indicated by the green area, despite leaving some consumer surplus from indication A still on the table, indicated by the blue area.

If we then examine Panel B for either Scenario 1 or 2 which describes profitability by the manufacturer leveraging indication-specific pricing, we can see that prices can be raised or lowered depending on what the end consumer is willing to pay for each specific indication. In other words, the manufacturer can extract the most money each patient is willing to pay, leaving no consumer surplus. In the cetuximab example, the manufacturer may decide to raise the cost of the drug to $240,000/ mo for indication A, $90,000/ mo for indication B and then lower the cost of cetuximab to $3,000/mo for indication C which contains the largest number of patients, albeit for the “lowest value” indication. In this ideal scenario, all patients will gain access to the drug, payers will come out potentially “even” in terms of overall expenditures, and manufacturers will be able to maximize profits while still being incentivized to discover novel compounds in niche indications where the patient value is highest.

Garnering Advice for Aligning Price and Value Across Indications

With the ever evolving payer landscape and increased complexities involved with developing and launching novel compounds in the market, manufacturers need to leverage all of their resources to fill in knowledge gaps as they grapple with pipeline and current product launch timing, pricing and which indications should be submitted to regulators and payers. It is important for manufacturers to engage with key stakeholders early on in the process to ensure they have properly vetted all elements to their regulatory, pricing, reimbursement and launch timing decisions with experts in each of these areas.

Fortunately, Impetus Digital can assist manufacturers in vetting their indication-specific pricing models and scenarios, leveraging the expertise of select stakeholders, to give timely and expert advice on best options to maneuver through the regulatory and reimbursement decision making process. Stakeholders can include ex-payers, health economic experts and physicians if required. Enrolled advisors can be engaged through a series of online touchpoints either in the form of web meetings or online asynchronous assignments delivered as survey questions via InSite Surveyor™, discussion questions via InSite Exchange™, or annotation exercises. Advisors can assist manufacturers in understanding the current payer landscape, supporting or refuting proposed value propositions and messaging by payer type, and vetting indication-specific pricing plans and launch sequencing strategies. Through online engagements, manufacturers can vet their pricing scenarios and ask a series of relevant questions that will assist in their final strategic decisions:

- How will indication-specific pricing impact price and market access for your launch indications and future indication expansions?

- How should you demonstrate and communicate your asset value to payers for optimal reimbursement across indications?

- How should you determine the appropriate price for each indication and how should you capture the value of therapy while maximizing patient access and your overall product revenue?

- How should you manage potential expectations for managed entry agreements and what should you do to prepare for these negotiations?

- What incentives must remain in place in order for you to validate launching indications where there is potentially higher or lower clinical benefit for patients?

The virtual nature of the boards and working groups can help to increase the engagement rates of advisors who are often extremely busy and being utilized by multiple manufacturers for similar purposes. Also, the assignments, which are compelling, relevant, and timely, can give the advisors or steering committee members time to pause, reflect, process, and review their colleague’s comments on their own time, allowing for more thoughtful and granular insights shared through the online forums. All of the assignments are created, programmed, project managed, and reported out by Impetus and their technical team (market access and health economic subject matter experts); hence, the manufacturer’s workload is minimal and so are the costs when compared to more traditional in-person consultancy meetings. Virtual advisory boards and working groups are excellent tools for manufacturers who need efficient ways to validate assumptions, content, and models when planning and implementing indication-specific pricing portfolio strategies.